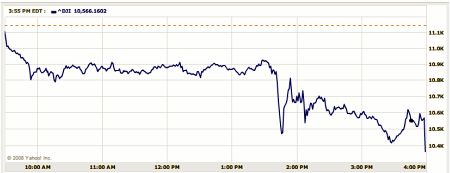

That's the U.S. stock market's Dow Industrials average for today. With a nasty 400-point drop in five minutes, followed by an immediate rebound, then another 200-point drop.

Talk about some wicked airtime! Man, I hope those lap bars were well padded. ;-)

Let's make this an open thread, to talk about the stock market, the economy, the mortgage mess, or whatever else might be affecting your love for theme parks and ability to go visit them.

Personally, I think a lot of people in Washington and on Wall Street are operating under the delusion that what we have is a liquidity crisis, a crisis of confidence. I think what we have is a solvency crisis, due to banks abandoning sound lending principles. They gave too-large mortgage loans to people who would never be able to repay them, under the assumption that housing prices would rise forever, making the borrowers' inability to earn enough money to make those payments irrelevant. (They'd just refinance against the rising home values.)

That's a great Ponzi scheme, until you run out of borrowers suckers. When we did, prices stalled, pushing some borrowers into foreclosure, leading prices to decrease, pushing more into foreclosure, causing prices to crash. Then the value of the securities backed by those mortgages crashes, as well. Leading us to where we are today.

What does this mean? Well, home equity loans paid for a heckuva lot of Disney World trips over the past six years. With those gone, life's gonna be tough for theme parks that don't have compelling new rides and aggressive discounts or deals to offer a cash-strapped market.

Tweet

Some of these drops aren't roller-coaster drops, they are Tower of Terror drops.

That said, I am psyched to see this mess getting people engaged in politics and government again. It's our government, folks (okay, I'm writing to U.S. readers here, indulge me please, international readers...). Let's make 'em do what we want 'em to do, not what George ("How can you tell I'm lying? Like my dad said, read my lips! If they're moving, I'm lying!") Bush wants Congress to do.

I gotta figure that the Orlando parks are hoping for another year of a weak dollar, to pull in international visitors to replace the U.S. visitors who can't afford to come. But if this really does become an international recession, I wonder if a weak dollar will be enough to help the Orlando parks.

Would any European readers like to comment on their visit plans for U.S. theme parks next year?

Anyway, a lot of parks had successful years for economic reasons. Disney with the strong international base, Cedar Fair and other regionals with the "staycation" trends this year. Those that can adapt will survive.

Back to the first post about when was the last time the DOW dropped this much. This was the largest single day drop in the history of DOW, surpassing the day the market open after September 11th, 2001. However, it is not the largest drop percentage wise (this drop ranked 17th all time). That record belongs to Black Monday in 1987 and before the Great Depression.

The only thing I see in this proposed "bailout" is US taxpayers (that's a great many of us TPI readers included) being forced into bailing out giant banks and investors so that THEY won't have to deal with the consequences of their own short-sighted greed and stupidity.

Why the blazes should we give these idiots such a golden parachute? What have they possibly done to deserve it?

Our alleged leaders keep talking about some sort of catastrophe if we don't do the bailout? OK... Bring it! LET the meltdown happen, and don't give the frelling investors one red cent of taxpayer money! Maybe having to actually deal with the consequences of their own actions will teach them a few things about personal responsibility.

Happy travels.

Also, as more financial institutions fail, credit will get tighter, and lending will become very limited. Some companies borrow cash each month to make payroll...so paychecks will bounce. Furthermore, people won't be able to get loans to buy cars, houses, major appliances, vacations, home improvements, etc. And without those big ticket purchases, business will have to cut back. Cut backs usually lead to laid off workers and the problem just continues to escalate.

The crisis may be on Wall Street right now, but Main Street is just on the other side of Wall Street, so something has to be done. What? I don't know. But then, I am not an expert, just a Theme Park Insider.

I refuse to support a bailout that doesn’t include punishment for those executives that put us in this situation. The mortgage industry was rampant with fraud, making it possible for anyone to qualify for any mortgage. That’s what drove real estate prices more than anything IMO.

People were allowed to take out a 2nd mortgage on properties they were buying to pay the down payment on the 1st mortgage. Tell me how does this work legally? A bum in our area managed to buy 14 high priced condos without putting a cent down. Now all his properties are in foreclosure (amounting to $5 million). Another guy claimed on his mortgage application that he made $17,000 a month working as a clerk at a rental car company. It was approved.

Nothing was verified in order to line the mortgage companies’ pockets and now they want a bailout? Why don’t they pay back the bonuses they received for these bad debts? They pillaged our economy. For that they deserve jail time, not bailouts. If they really want the companies to stay afloat, let them file for bankruptcy, like other corporations have done.

I'm not European, but rather Canadian. Typically, we try to visit when the Canadian dollar is booming and when the USD is low. If anything, your financial issues encourage us to visit. That probably makes me sound like an ass ...

I don’t think most people realize the magnitude of the crisis. If you want to get an idea of how big this problem is, go to realtytrac.com and key in your zip code. My area currently has close to 1,000 properties somewhere in the foreclosure process. Who’s going to maintain these properties if the government decides to hold them until the market comes back? Who will cut the grass and clean the pools? In my neighborhood, the HOA can hire someone if the property gets ratty, and issue the bill to the deed- holder. That’s going to cost the government more than they think, and is another opportunity for fraud. It sure beats a malaria outbreak caused by green pools, though.

Then there are also monthly maintain fees on condos. If a complex is at a 15–20% foreclosure rate (which is typical in New Tampa), is the government going to pay the $300/ month fee for the units they take over? I would imagine most complexes need the money to properly maintain the grounds. If it isn’t paid, the complex’s value will drop and screw the people that are still living there. If they move in low-income, there will be more people abandoning their units and, again, we will be left holding the bag.

I’m not ready to drink the “it must be done" Kool-aid quite yet, but something will have to happen and $700bil is just scratching the surface. The least that should be done is to punish the mortgage companies that falsified data for high commissions. This was a crime and needs to be treated as such. We can't afford to let this happen again.

This article has been archived and is no longer accepting comments.

I'm curious - when was the last time DOW dropped so suddenly?