Blackstone's a major player in the theme park business. In addition to its stake in Universal Orlando, it owns SeaWorld Parks & Entertainment and co-owns Merlin Entertainments, the owner of the Legoland theme parks. As such, it owns or co-owns every major non-Disney theme park in Central Florida.

Blackstone acquired its stake in Universal Orlando when it obtained the Rank Organisation, the original partner with MCA (the former owner of Universal Studios) in what was then just the Universal Studios Florida theme park and a bunch of surrounding land.

According to an SEC filing, Blackstone has offered to sell its share to fellow co-owner NBCUniversal, which would then own all of the resort.

NBCUniversal has until June 12 to agree to the deal. What if it doesn't? This is where things get interesting. In that case, Blackstone has the right to solicit bids for the entire resort, which could transfer its ownership - and NBCUniveral's - to another company, according to a "drag-along provision" in their agreement:

UCDP [Universal City Development Partners - the holding company that controls Universal Orlando - Ed.] was informed on March 9, 2011 that Blackstone triggered the right of first refusal and offered to sell its interest in UCDP to the NBCU Parties, who have until June 12, 2011 to accept Blackstone’s offer or be subject to the drag-along provisions in the partners’ agreement. We will cooperate to facilitate a sale pursuant to the terms of the partners’ agreement, including bearing the transaction costs of any such sale, but any decision regarding the timing and terms of a sale is outside of our control. Accordingly, although Blackstone has triggered the right of first refusal, we cannot make assurances that a sale of Blackstone’s or NBCU’s ownership interest in UCDP will occur or, if it does, the timing, terms or impact on UCDP of any such sale.

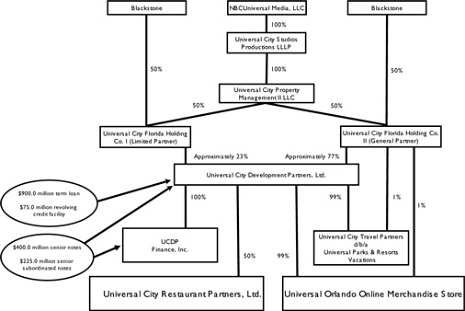

By the way, did you ever wonder what the ownership of Universal Orlando Resort looked like? Well, here it is, in convenient chart form. :^p

The details of the SEC filing also reveal lots of information about what happens to branding agreements within the park, including the Universal name, should the resort be sold to a third party. (Basically, many go away eventually, and Warner Bros can pull the Harry Potter license upon a sale if it doesn't like the new owner.)

Finally, props to Universal for name-checking Theme Park Insider in the filing. That's gotta be a first.

Have at it in the comments, folks.

Tweet

Why not sell its 50% in Universal Orlando at the top of the market to a new Universal owner, generating some cash that (one hopes) could be used to upgrade the SeaWorld parks? (Okay, I'm an optimist...)

If I were Universal, I'd certainly want to control all of my biggest domestic theme park asset. Harry Potter's going to be bringing cash for some time. Why share that with someone else? If NBCU can come up with the cash to make this deal, I think it has to.

No way I see this coming to the point where third parties get involved. Blackstone wants some cash, and it's going to get it.

We are rolling now!

Unless Blackstone sells its share back to Universal, this property isn't worth as much to the new owners. It will slowly atrophy.

I can't see why Disney would buy it. They would only buy it to close it, but it will be at a high cost.

One would think that Disney knows the parks business well enough to make a fairly educated guess about what Universal's financial standing is ... assuming they even care that much.

Speilberg's deal with Universal was done when the first park was new and they thought they needed him to compete with Disney. He has an incredibly rich deal and is laughing all the way to the bank no matter what.

Disney already sees the books through the Marvel license. And you need a lot more than one share to see the books. No way Disney gets involved here -- they have enough exposure to Orlando.

NBC people have long run the parks with Blackstone largely in the background. They've made a bucket of money on the investment (they took a big dividend in 2004) and took a chance by agreeing to do Harry Potter (and adding back money to do so).

And Comcast has only spoken positively about the parks. Expect NBCU to take over or no deal to happen. No third party is coming in without NBCU/Speilberg/WB's approval.

I respond: Yeah but (as I posted) with Disney's knowledge of theme park operations and the information in quarterly numbers the Mouse wouldn't need that much more than one share. Plus that gets Mickey a free annual report.

I wonder if Disney owns any shares of Comcast?

Is that supposed to be "locals" or "local's" or "locals'?"

This article has been archived and is no longer accepting comments.

As for the eventual sale, if NBC does not pick up the ownership from Blackstone, does that mean someone like, uh, let's say, Disney, could sweep in and turn the world on its head once again?